When engaging in US stock trading, understanding the associated fees is crucial for managing costs and maximizing potential returns. Tiger Brokers offers a transparent commission structure for US stock investments, allowing investors to clearly understand their costs. In this article, we’ll take a look at US stock trading fee and compare Tiger Brokers’ pricing with other platforms.

Tiger Brokers’ US Stock Trading Fee Structure

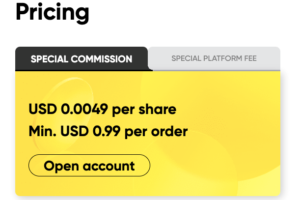

Tiger Brokers offers competitive fees for trading US stocks. Their commission rate is USD 0.0049 per share, with a minimum of USD 0.99 per trade. This low fee structure allows investors to trade without being burdened by high costs, making it accessible for both beginners and seasoned traders alike.

Additionally, Tiger Brokers charges a platform fee of USD 0.005 per share, with a minimum of USD 1 per trade. This fee is relatively modest compared to many other brokers, making it an affordable option for those looking to invest in US stocks.

How Tiger Brokers’ Fees Compare to Other Platforms

When comparing US stock trading fees across different platforms, Tiger Brokers stands out for its transparency and competitive pricing. Many other brokers charge a flat fee or a percentage of the trade value, which can lead to higher costs for smaller transactions. In contrast, Tiger Brokers’ per-share fee structure ensures that the costs remain proportional to the size of the trade.

Compared with high commission fee charge by traditional brokers, Tiger Brokers’ fees are significantly lower, particularly for investors making smaller trades or trading frequently.

Conclusion

Understanding US stock trading fees is essential for investors looking to minimize costs and maximize returns. With Tiger Brokers, the transparent fee structure—USD 0.0049 per share for commissions and USD 0.005 per share for platform fees—provides a cost-effective solution for those interested in US stock investments. By comparing fees across platforms, Tiger Brokers proves to be a competitive choice for investors seeking affordable and transparent trading costs.